The BE-12 report is a statistical report required by certain U.S. companies and individuals to analyze the impact of direct investment on the economy. The report helps the US government assess the scale and impact of foreign business in the country.

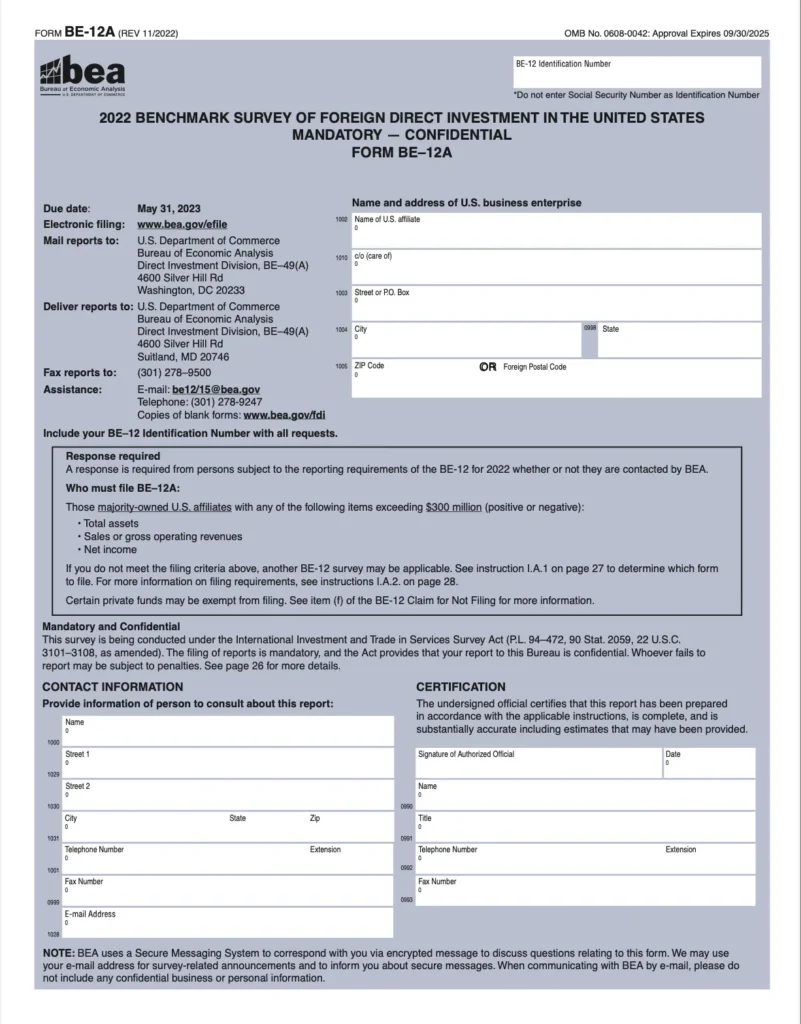

Who should file the BE-12 report?

Companies incorporated in the United States in which a foreign person or entity owns or controls 10% or more of the share capital at the end of 2027, regardless of the company’s activity. The next report is due in 2028, so the rules may change.

Companies or individuals owning real estate in the United States are held primarily for commercial lease.

Deadlines for filing BE-12

The BE-12 form must be filed by June 30th of the reporting year, submitted electronically via the eFile system. The next deadline is June 30, 2028. While you can complete the form yourself, the process can be complex and often requires expert guidance.