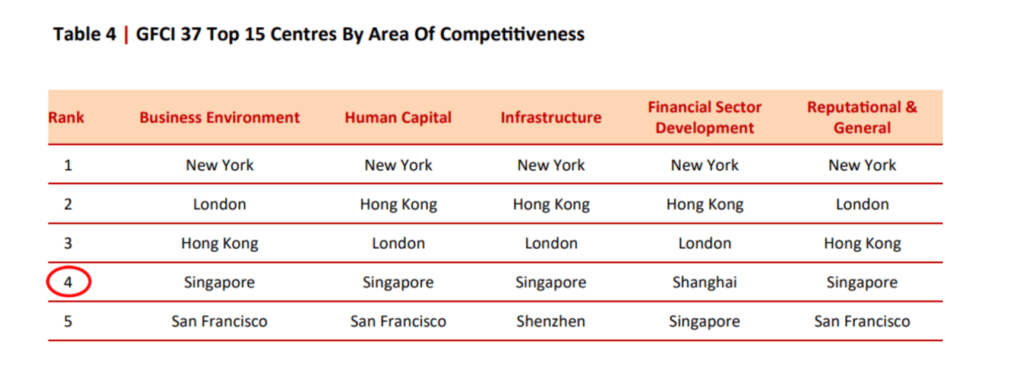

Recently ascending to 4th place, Singapore is widely recognized as one of the best places in the world to start and grow a business, attracting thousands of entrepreneurs and multinational companies every year. Currently, the no.1 favorite city for business in the ASEAN region.

Why Singapore is ideal for business?

Singapore is one of the easiest countries in the world to start and run a business., thanks to efficient regulations, a transparent legal system, and consistently strong performance in global benchmarks like the World Bank’s Ease of Doing Business Index. It offers a competitive corporate tax rate, no capital gains tax, and generous tax exemptions for startups. With 27 free trade agreements, including Regional Comprehensive Economic Partnership (RCEP) and Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), Singapore provides strategic access to Asia-Pacific markets. Singapore’s participation in both RCEP and CPTPP, allows businesses based there to access a vast network of markets in the Asia-Pacific region with reduced trade barriers and enhanced economic opportunities, opening doors to vast markets across Asia and beyond.

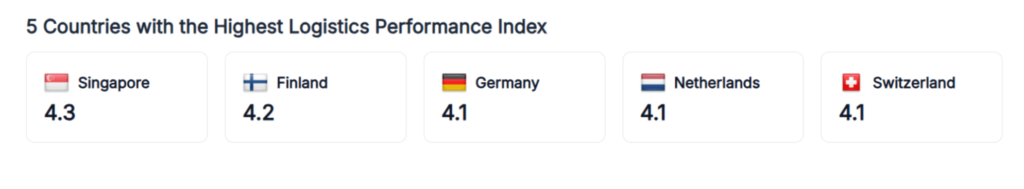

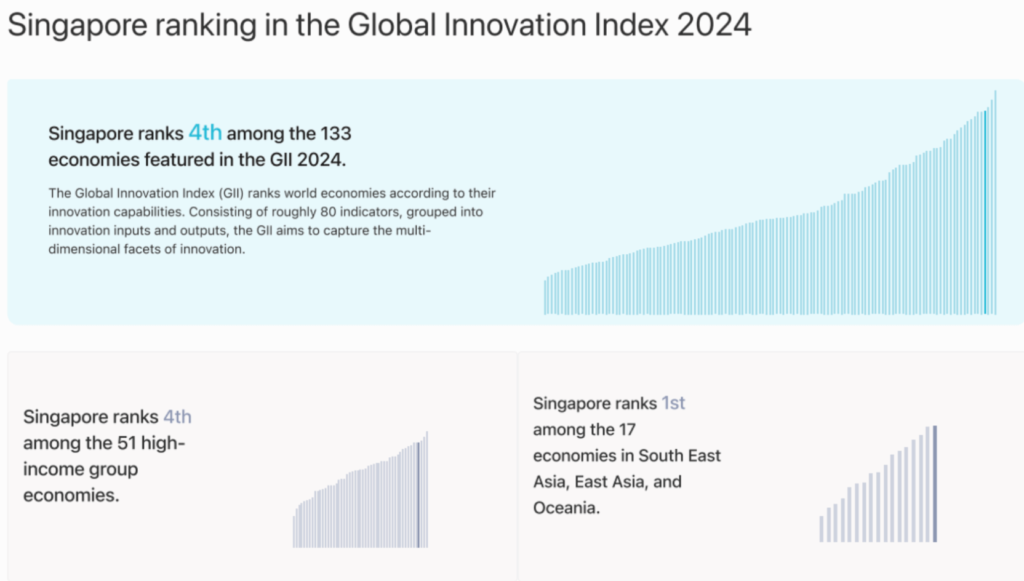

The country also ranks high in intellectual property protection, supported by strong legal enforcement and a pro-innovation ecosystem, as highlighted in the WIPO 2024 Report. A highly skilled workforce, bolstered by programs like SkillsFuture, and near-complete 5G coverage make Singapore especially attractive to tech, finance, logistics, and international trade businesses.

Whether you run a SaaS company in Germany, a fintech platform in Spain, or a logistics firm in Poland, Singapore provides investor confidence, regional connectivity, and business stability.

Understanding the Tax System in Singapore

Singapore’s tax system is designed to encourage business growth and entrepreneurship. While the standard corporate tax rate is a flat 17%, many companies benefit from significant exemptions and rebates that reduce their effective tax burden. In Singapore, corporate tax residency is determined by the place where the company’s central management and control are exercised. Generally, this refers to the place where directors meet to make key management decisions. Therefore, appointing a local director is essential.

More about taxes in Singapore:

- CIT (Corporate Income Tax) – 17%

Important: The country offers partial tax exemption provided as a deduction when calculating the taxable base (the profit is taxed at the standard rate).

|

Taxable Profit (SGD) |

Exempted from Tax |

Non-Taxable Income (SGD) |

|

First 100,000 |

75% |

75,000 |

|

Next 100,000 |

50% |

50,000 |

|

Total |

|

125,000 |

Tax Exemption for Startups as a Deduction When Calculating the Taxable Base (the profit is taxed at the standard rate)

|

Taxable Profit (SGD) |

Exempted from Tax |

Non-Taxable Income (SGD) |

|

First 10,000 |

75% |

7,000 |

|

Next 190,000 |

50% |

95,000 |

|

Total |

|

102,500 |

Singapore does not charge a dividend tax – the rate is 0%, but GST (Goods and Services Tax) applies, currently set at 9%.

GST (Goods and Services Tax) registration is mandatory only if the company makes taxable supplies exceeding 1 million SGD within a 12-month period. Voluntary registration is permitted if the taxable supplies are below this threshold, subject to certain conditions. After GST registration, the business may claim input tax deductions on its purchases and expenses, provided that the established conditions for input tax are met. We’ve put together a detailed breakdown of these tax schemes and other incentives just for you. Check out our, Guide to Corporate Tax in Singapore.

Banking and payments

Opening a corporate bank account in Singapore is typically fast and efficient once your company is incorporated. The country’s top-tier banking system is one of the most trusted in the world, and it plays a vital role in Singapore’s appeal as a global business hub.

Leading banks such as Development Bank of Singapore Ltd (DBS), Oversea-Chinese Banking Corporation (OCBC), and United Overseas Bank (UOB) provide comprehensive digital banking solutions tailored to businesses of all sizes. These include multi-currency accounts, virtual cards, real-time FX conversions, and cross-border payment capabilities, essential tools for companies engaging in regional or global trade.

While some banks still require an in-person verification for KYC (Know Your Customer) compliance, especially for foreign directors or complex ownership structures, many offer remote onboarding for straightforward business profiles or where local directors are present

- Company’s Certificate of Incorporation

- Business profile from ACRA

- Company Constitution

- Board resolution authorizing account opening and signatories

- Identification and proof of residential address for directors, signatories, and ultimate beneficial owners

- Business plan or description of activities (sometimes requested)

- Minimum deposit (varies by bank or payment system)

|

Aspect |

Details |

|

Account opening time |

Depending on the company structure and the director’s presence |

|

Physical presence required |

Usually required for foreigners or complex ownership; remote onboarding possible |

|

Key banks |

Digital banking |

|

Services offered |

Multi-currency accounts, virtual cards, FX conversions, cross-border payments |

|

Required documents |

Incorporation certificate, ACRA business profile, constitution, board resolution, IDs, proof of address |

|

Compliance |

Strict Know Your Customer (KYC) and Anti-Money Laundering (AML) checks; banks may request business plans and background info. |