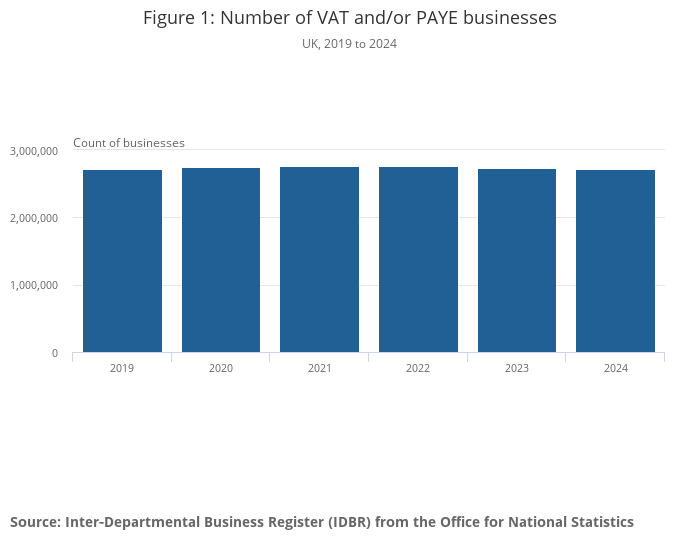

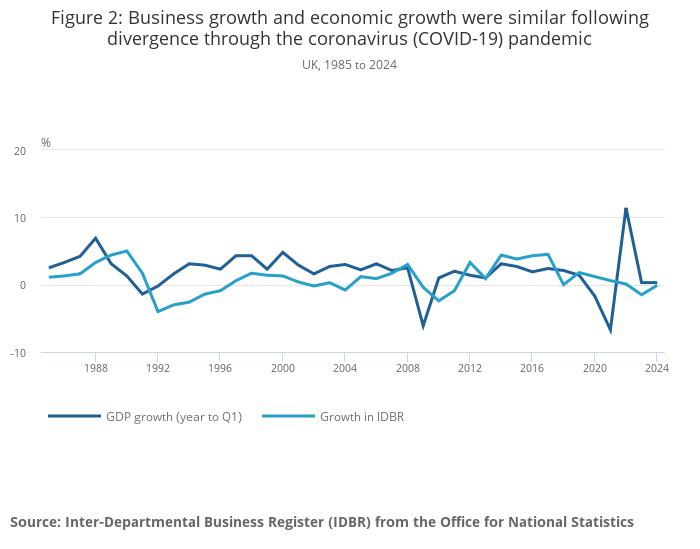

Over the past decade, the UK has seen a noticeable trend in the growth of registered businesses. According to the Department for Business and Trade, from 2010 to 2024, the total number of businesses increased by 1 million, representing a 23% rise.

As of early 2024, there were 5.5 million private sector businesses:

- 5.45 million were small businesses with 0 to 49 employees

- 37,800 companies were medium-sized, with 50 to 249 employees

- 8,250 businesses were large, employing 250 or more people

How can a startup break into the UK market?

Registering a startup in the UK is a promising step for entrepreneurs aiming to enter international markets and take advantage of all the benefits offered by one of the world’s most powerful economies. Cities like London, Manchester, Birmingham, and others are known as leading tech hubs with easy access to a skilled workforce, venture investors, and accelerators.

The UK’s legal system protects intellectual property, which is crucial for IT companies. Additionally, clear and transparent regulations create a predictable business environment.

- R&D Tax Credits — reimbursement for research and development expenses, which can cover up to 33% of costs

- Patent Box Regime — a reduced corporate tax rate (10%) on income earned from patents

- Other grants for startups, including through UK Innovate programs

However, there are some challenges to consider. The high level of competition in the market requires careful planning, and while the regulatory environment is transparent, it still involves adhering to numerous formalities related to taxation. Let’s take a closer look at these challenges.

Source Inter-Department Business Register (IDBR)

Starting Your Own Business in the UK: types, requirements, benefits

Setting up a Limited Company (Ltd) in the UK is one of the best options for startup founders looking to break into the global market with minimal costs. You can register online through the Companies House portal in just 24 hours, and with no minimum capital required, you can get started with as little as £1.

This business structure is known for its transparency: founder information is available in the public registry, which enhances trust among international partners. London, as a global business hub, is home to over 1 million LTD companies. Additionally, an LTD can be fully owned by foreigners, making it easier to expand into the UK market.

Administrative costs are minimal, as are the reporting requirements for small companies with an income of up to £10.2 million. The registered address can be anywhere in the country, and the lack of a need for physical presence opens up additional opportunities for international startups. Easy liquidation of an LTD makes it an ideal tool for testing business ideas.