So, you’ve joined a startup, received stock options, and heard whispers about something called an “83(b) election.” You’re probably wondering what it is, if you need it, and why it matters. If you’re starting a business or receiving company shares as part of your job, you might have come across the term 83(b) election. It sounds technical, but at its core, it’s just a decision about when to pay taxes on shares that haven’t fully become yours yet. Making the right choice could save you a lot of money in the long run. This article breaks down Form 83(b) and its implications for founders and early employees.

Understanding the 83(b) Election in Simple Terms

Imagine you’ve just joined a promising startup, and as part of your compensation, the company gives you shares. The catch is, you don’t own them all at once. Instead, the company has a vesting schedule, meaning you’ll gradually receive full ownership over time—perhaps over four years.

Now, here’s where tax laws come into play. Normally, you’d pay tax each time a portion of your shares vests, based on their value at that moment. If the company grows quickly and the shares become more valuable, you could end up paying a much larger tax bill than you expected.

The 83(b) election lets you avoid this by paying tax on the total value of your shares right away, at the moment you receive them—even though they haven’t vested yet. This means you pay tax based on their current (and usually much lower) value, rather than the higher future value.

Why Does This Matter – Case Study

To see how this plays out, let’s look at two startup employees, Omelia and Mike. Both receive 10,000 shares from their company when they start working. When they receive them, each share is worth just €0.10, making the total value of their shares €1,000.

Omelia, being financially intelligent, decides to file an 83(b) election right away. She pays tax immediately on that €1,000 and doesn’t have to worry about taxation again until she sells the shares. Over the next few years, the company grows rapidly, and by the time she’s fully vested, her shares are worth €10 each. When she eventually sells them, she only pays tax on the profit she makes at that point—at the much lower capital gains tax rate instead of the higher income tax rate.

Mike, on the other hand, doesn’t file the 83(b) election. He assumes he’ll deal with taxes later. However, as his shares vest over the next few years, their value keeps increasing. By the time he officially owns all 10,000 shares, they’re already worth €5 each, meaning he suddenly owes income tax on €50,000—a tax bill far larger than Omelia’s. Worse still, when he eventually sells the shares at €10 each, he has to pay additional tax on the increase from €5 to €10.

By taking action early, Omelia paid significantly less tax than Mike. Filing an 83(b) election gave her an advantage, locking in a low tax rate at the beginning and reducing her overall tax burden.

When Should You File Form 83(b)?

Filing Form 83(b) makes the most sense if you’re confident that your company’s stock will increase in value over time. By paying taxes on your shares early, you can lock in a lower tax rate before their worth skyrockets. But this decision isn’t just about future gains—it also depends on your current financial situation. If you have the cash available to cover the tax bill now, it might be worth avoiding a much higher tax burden later.

That said, this choice isn’t without risks. You’re essentially betting on your US company’s success. If things don’t go as planned and your company doesn’t take off, you’ll have paid taxes on stock that never appreciates in value. That’s why it’s important to consider not just the potential benefits but also the risks involved.

The Risks of Filing Form 83(b)

Once you file Form 83(b), there’s no turning back. The election is permanent, even if your company fails. You will have already paid taxes on shares that may never be worth anything, and there’s no way to get that money back. If your stock decreases in value or the company fails, you would have already paid taxes on a higher value.

Timing is another critical factor. You only have 30 days from the moment you receive your shares to file. Miss this deadline, and you lose the opportunity altogether. That’s why, if you’re considering making this election, you need to act quickly and make sure all paperwork is in order.

- Founders: Almost always a good idea, as they typically receive shares at very low valuations.

- Early Employees: Highly recommended, especially those joining before significant valuation increases.

- Anyone with Low FMV Shares: If the fair market value (FMV) is low at grant, explore the benefits.

- High Valuation at Grant: If the company’s valuation is already high, the upfront tax cost may outweigh the future benefits.

- Small Number of Shares: The potential tax savings might not justify the effort and potential risks.

How to File an 83(b) Election.

If you decide to go ahead with an 83(b) election, you must act fast. The IRS requires you to file the form within 30 days of receiving your shares. There are no extensions, and if you miss the deadline, you lose the option entirely. Most people work with a tax advisor to ensure everything is done correctly, as mistakes can be costly.

To file an 83(b) election:

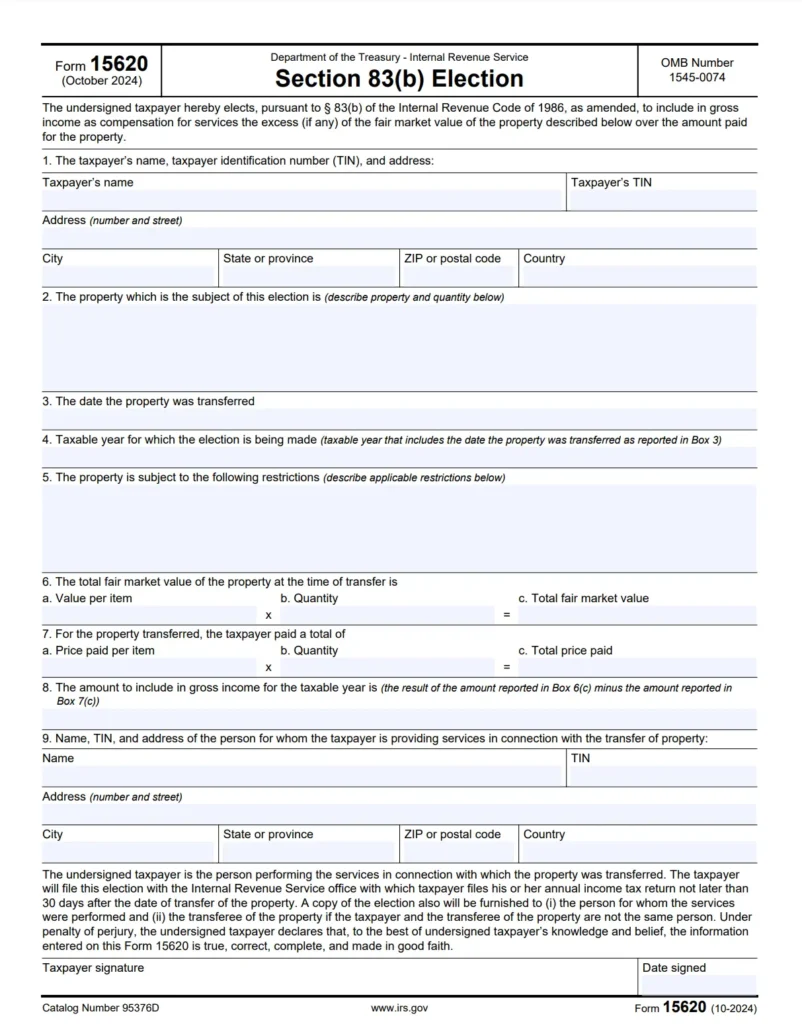

- Complete IRS Form 83(b): Include details about the stock, fair market value, and date of receipt.

- Mail the Form to the IRS: Send the form via certified mail within 30 days of the grant date.

- Send a Copy to Your Employer: Your company may need a copy for its records.

- Keep a Copy for Your Records: Retain a copy for your personal tax filings.

When you fill out the form, you’ll need to provide the following information:

- Name

- Address

- Social security number (SSN)

- Number of shares

- Type of shares

- Issuing company name

- Date granted or purchased

- FMV on the above date

- Amount paid for shares

- Your gross income

Final Thoughts

Equity compensation can be a game-changer, but only if you understand the tax implications. The 83(b) election gives you the opportunity to take control of your tax situation early on, potentially saving you thousands—or even millions—in the long run. However, it’s not a decision to take lightly. Filing too soon without considering the risks can leave you paying taxes on shares that never increase in value.

This is where Finevolution comes in. We can assist with correctly filling out the necessary forms, ensuring everything is completed properly and on time. Whether you need help submitting your 83(b) election, handling Form BE-12, completing Form W-8BEN, or filing the BOI report, our team is here to streamline the process, so you can focus on growing your business with confidence.

Still have questions or need assistance with filling out an 83(b) election? Get in touch—we’re here to help. Our team is ready to provide consultation on these issues. Our business hours: Monday to Friday, 9:00 AM — 7:00 PM. Contact us via WhatsApp, Telegram, or Viber, or submit an inquiry through our online form.